Life is full of surprises; every day brings a new surprise to man. A person’s life and possessions are surrounded by the risk of death, disability, or destruction. These risks can result in financial loss, insurance is a wise strategy to transfer such risks to an insurance company. Insurance is the most effective risk transfer mechanism for protecting individuals, properties, and businesses from financial risks arising from unexpected disasters. Let’s discuss what is insurance and types of insurance offered by the different insurance companies.

What Is Insurance And Types:

What Is Insurance?

Insurance is a legal agreement between the insurance company (the insurer) and the person (the insured), in which the insurance company makes the guarantee to make up for financial losses caused by unforeseen events in exchange for the premiums paid by the insured person. This could be the death of the policyholder or loss of property and the amount that you pay for this arrangement is known as premium.

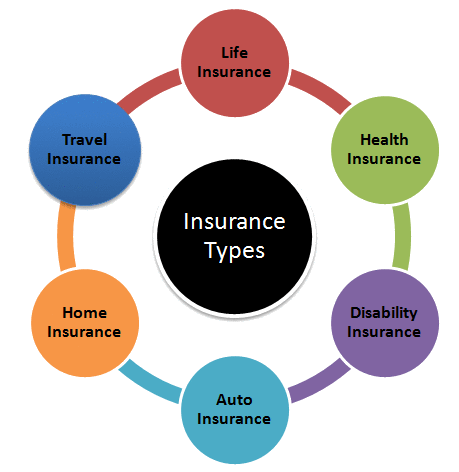

Types Of Insurance:

Insurance policies are used to protect against the risk of both large and small financial losses. There are several types of insurance to help after various unforeseen disasters. Here are the main types of insurance policies to help you sort through your options.

1.Life Insurance:

As the name refers, life insurance is insurance for someone’s life. When one can get life insurance, the insurance policy guarantees that the insurer protects the family in case of premature death or death during the policy period. If the insured person dies suddenly, it pays a lump sum payment to the family in exchange for the premium paid during their lifetime. This helps the bereaved family overcome any financial difficulties.

2. Home / Property Insurance:

If your question is, what is house insurance? The answer is Home / Property insurance is a type of insurance in which the policyholder covers financial loss and provides financial assistance if your valuable property is damaged against a specific risk. Losses from man-made or natural calamities such as theft, flood, or other accidents can be mitigated.

3. Accident and Disability insurance:

what is accident insurance? Accidents are unpredictable and sometimes they can lead to disabilities that can affect your earning capability. Accident insurance is a form of insurance policy that offers a payout for injuries or fatalities brought on by accidents. The insured person can spend the benefit payout may be used as he chooses. Accident insurance is essential if you want to achieve financial security for your family and yourself.

4. Medical / Health Insurance:

Do you want to know what is medical insurance? The insurance policy covers the costs of hospitalization, medical visits, and medication prescription. Insurance companies offer A variety of health insurance policies to cover various diseases and afflictions. Both generic and disease-specific health insurance plans are available for buy. The premium paid for a health insurance policy usually covers the medical costs for expensive treatments, hospitalization, and medicines.

5. Auto / Vehicle Insurance:

Auto insurance is a form of insurance policy in which policyholders cover financial loss in case you’re involved in an accident or the vehicle is stolen, vandalized, or damaged by a natural disaster. People pay annual payments to a car insurance company instead of paying for auto accidents out of pocket, and the company then covers all or most of the expenses related to the road accident or other vehicle damage. Having a comprehensive car insurance policy is very important given the increasing number of traffic accidents and the value of assets.

6. Travel Insurance:

what is travel insurance for? Travel insurance is a form of insurance policy that covers travel costs and risks. It is beneficial protection for both traveling nationally and internationally. Some travel insurance policies cover loss to baggage, rented vehicles, and even the cost of paying a ransom. The basic forms of travel insurance involve insurance for trip cancellation or interruption, baggage and personal effects, medical expenditure, and accidental death or flight accident insurance.

7. Business Insurance:

Do you know what is business insurance? Business insurance is one of the mandatory policies in current times. Every business requires business insurance to cover the costs of property damage and liability claims. It provides several coverage options to protect your company’s property, inventory, equipment, and cash loss due to business interruptions.

List of top insurance companies in Pakistan:

Here we will show you a list of top insurance companies in Pakistan that are working to provide the best insurance services to Protect you from losses.

- Jubilee Life Insurance

- Adamjee Insurance

- EFU General Insurance

- State Life Insurance Corporation of Pakistan

- Alfalah Insurance Company

- Askari General Insurance Company

- TPL Insurance

- Alpha Insurance Company

- United Insurance Company (UIC)

- East-West Insurance Company

- Pak Qatar General Takaful

- SPI Insurance Company

- Asia Insurance Company Limited

- Online Travel Insurance company