Starting a new business is one of the most interesting and rewarding experiences, but how can you get started? There are many various approaches to starting a business. Before starting s business, there are various essential things you need to account like your business idea, how much time it will need, your business location, your business plan, and how much money you want to invest. These things are important and the same to start a business, whether, it is your first business or your 10th. In this article, we will discuss how to start a small business.

How to Start a Small Business?

Starting a new business is not an easy task but the following steps will help you to move forward. Let’s see how to start a small business and what things are required. Here are some important steps you need to follow to start a new small business.

- Find a Business Idea:

- Write a Business Plan:

- Fund your Business:

- Choose The Business Structure:

- Decide your business location

- Register Your Business:

- Apply For Federal Tax ID (ENI)

- Apply for Business Insurance:

- Apply For License and Permit:

- Open A Business Bank Account:

- Grow Your Business:

1.Find a Business Idea:

If you are thinking about how to start a small business, the first thing you need to know is what kind of business you want to set up. You should start a business that interests you and also meets the needs of the market. For this, you need to make a list of your expertise and you can also do market research to refine your business idea. Market research can help you reduce risk because it informs you about the level of demand for your goods or services and the level of competition already present. In addition, it provides demographic data on your target customers, such as their income and place of residence. You may improve your business idea by doing this.

2. Write a Business Plan:

After choosing a profitable venture, the next stage is to write a business plan. A business plan helps you to identify your business objectives and how you can achieve them. A good business plan serves as a roadmap for you every step of the way to start and run a business and helps you organize and grow your small business. It can also help you attract partners and employees. When writing a business plan, you have two options: you can use the traditional method or lean. Traditional plans have in-depth information and are often needed to secure a business loan. In contrast, Lean plans are shorter and may contain more charts than written material. They’re often perfect for simple, quick-start small business models. Read more about how to write a business plan.

3. Fund your Business:

Funding your Business is the most important step for starting a small business. Every business has different financial needs. Therefore, a single financial solution is not fit all businesses. Your business’s financial destiny will be influenced by your personal financial condition as well as your company’s goals. You can determine how much money you’ll need to start your firm with the help of your business plan. once you have determined how much you will require, the next step is to determine how you will obtain the startup money. If you don’t already have that amount you require to meet your business needs. You will either need to raise money or get a business loan.

4. Choose The Business Structure:

After financing the business, the next step is to choose the business legal business structure. Choosing the right business structure is one of the important decisions to run your business. It helps to determine tax rates, management, fundraising capabilities, paperwork requirements, and many other factors. There are different business structures, you can choose one of them according to your choice. These business structures include sole proprietorship, Partnership, Limited liability company, Cooperative, corporation, or S corporation.

5. Decide Your Business Location:

Your business location is one of the most important decisions you’ll make to start a small business. Your business location whether you’re setting up a brick-and-mortar business or launching an online store determines the taxes, legal requirements, and regulations of your business. You will need to make a strategic decision about which location you choose to start your business. Where you locate your business depends on your target market location, business partners, and your personal preferences. You should also take into account the expenses, advantages, and limitations of various governmental organizations.

6. Register Your Business:

If you have worked hard to reach your goal and you believe that it has the potential to succeed in the market, then it is time to take your business to the next level by becoming it official. It may not always be necessary to register your small business with the government, but it could give you personal liability protection as well as legal and tax advantages. You might need to register in the state where your business was started as well as any other states where you conduct business, a process known as foreign qualifying. Depending on the state and business structure, registration documents may vary. However, the majority usually require:

- Business name

- Location

- Owner or management structure

- Name of registered agent

- Total number and value of shares, if applicable

- Local registration

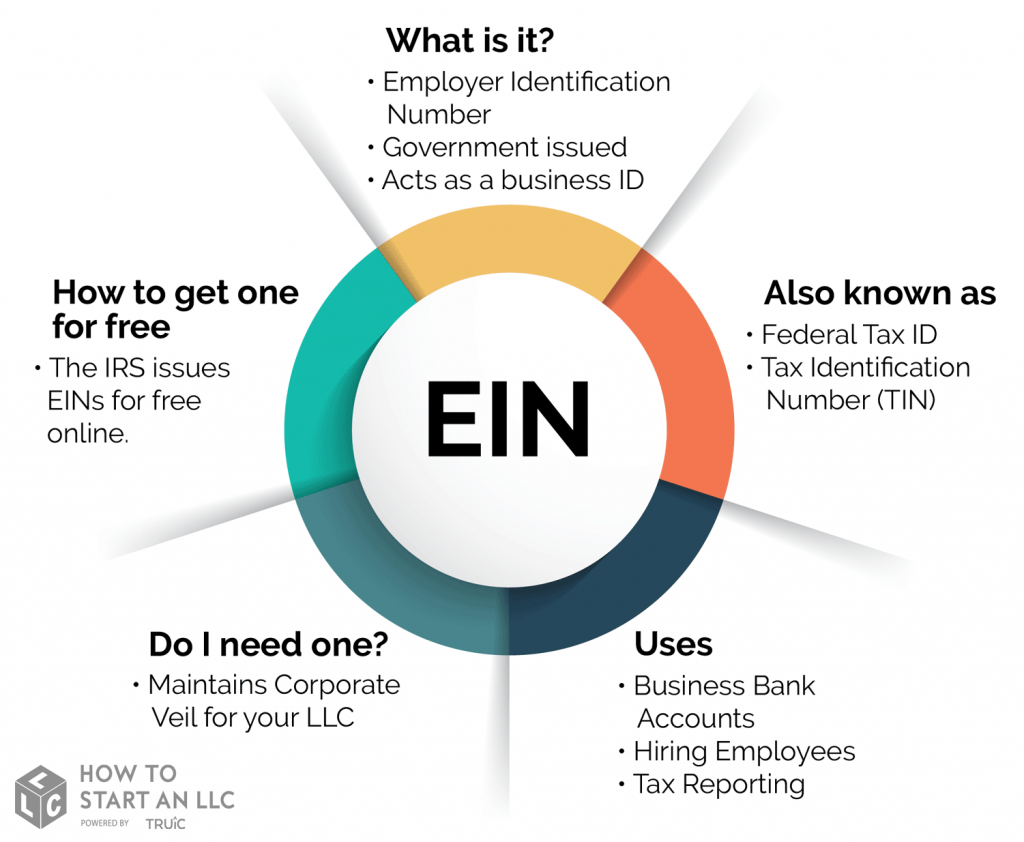

7. Apply For Federal Tax ID (ENI):

Once your business has registered. You should apply for an employer identification number (EIN). Your Employer Identification Number (EIN) is a federal tax number that identifies your business. This number is required in order to open a business bank account, file federal taxes, and hire staff. You can submit an EIN application from the IRS website.

8. Apply for Business Insurance:

A small business startup is labor-intensive and expensive. Therefore, you should save it with the appropriate business insurance. It is a good idea to consult an insurance representative for advice on insurance coverage that suits your business. You can choose a business owner’s policy (BOP) which includes three different types of coverage. business insurance coverage includes:

- General liability insurance: General liability insurance protects against bodily harm, property loss, or personal injury.

- Commercial property insurance: Commercial property insurance safeguards the equipment of your business.

- Business income insurance: In the event that you are unable to operate your business, this insurance might assist in covering costs like payroll.

- Professional liability coverage: If you are sued for negligence or mistakes in the services you provide, this insurance will protect you from financial loss.

9. Apply For License and Permit:

To set up or run your small business legally, you need to have all the necessary licenses and permits. To operate your business efficiently you need to stay legally compliant. Depending on your business’s business, state, location, and other criteria, you may need different licenses and permissions. If your business operates in certain industries, such as agriculture and broadcasting, you usually need a federal license. You require a professional license for other industries, such as healthcare, and if you do not fit into one of these categories, you may need some kind of permission to do business. It is worth consulting with a small business lawyer to get precise advice on which licenses and permits do you need?

10. Open A Business Bank Account:

Once your legal business structure has been established you should open a business bank account. Opening a business account is an important step because it separates your personal and company finances. A small business checking account can help you handle your day-to-day business, tax, and legal concerns. Partnering with a local bank will allow you to establish a personal relationship. Smaller banks are often considered more helpful and able to respond faster when a problem arises. If you have the necessary registration and paperwork ready, setting up a business account is easy.

11. Grow Your Business:

You cannot build a strong business without investing time and money. To run a profitable business, you will need to grow your business and establish a strong networking plan. You can grow your business in different ways. You can grow your business by making your products and services posts on various social media networks. This can help you to understand your customer’s needs. Another excellent way is to offer early customers a discount code that matches the profit margin that will give you popularity. This is the best way to increase visitors and sales for your business.