Business Insurance:

Do you know what is business insurance and how much is business insurance cost? Business insurance is an insurance policy that forms to combines protection from liability and property risk into a single package. Business insurance protects the business from financial losses that may occur during the course of the business. Every business needs business insurance to cover the costs associated with property damage and liability claims. A business insurance package offers a variety of cover options to protect your company’s property, stock, and equipment as well as financial loss due to business interruption.

The best thing about business insurance is that it can be customized to meet the specific requirements of any given business. Companies assess their insurance needs based on potential risks, which may be different depending on the type of company working environment. For instance, a sole-trader business operating in the professional services sector will require different insurance options than a business operating in the food and beverage sector. One of the most often asked queries by business owners is, how much does business insurance cost? But answering that is not an easy task because there are numerous variables that can affect the cost. Here we cover the topic of How much is business insurance cost?

Which Factors Affect the Cost of Business Insurance?

The cost of business insurance coverage may be different depending on your business. There are many factors that can help you decide how much to spend on business insurance.

1.Companies:

Some companies have higher risks than others. Therefore, you should know that your insurance rates reflect this increased risk. For instance, accounting companies will likely pay less for business insurance coverages than construction companies.

2. Employees:

Employees are another important factor that affects the cost of business insurance. Some types of business insurance may use the number of your employees as a factor in insurance costs, such as general liability insurance.

3. Payroll:

Payroll is one of the important factors that affect the cost of business insurance. The cost of particular insurance policies may vary depending on the payroll of your business. some business owners use payroll as a factor for the premium amount.

4. Claim History:

A company that has a perfect claims history displays experience and safety. It can reduce the cost of insurance.

Types Of Business Insurance:

There are different types of insurance that you can get depending on your business because each business deals with different risks and challenges. Read about the eight types of insurance that can help to protect many businesses from different types of risks.

- General Liability Insurance

- Commercial Property Insurance

- Business income insurance

- Product Liability Insurance

- Professional Liability Insurance

- Workers Compensation Insurance

- Data breach insurance

- Commercial Auto Insurance

- Cyber Liability Insurance

- Errors and omissions insurance

How much is Business Insurance Cost by Policies?

Different types of insurance will offer different considerations, but they may also vary in cost. Some insurance policies cover intellectual property or income, while others protect your physical assets or provide coverage for bodily injuries. The costs of typical policies that cover the majority of circumstances that business owners may encounter are listed below:

1.General Liability Insurance:

general liability insurance protects your business from legal requirements that may be incurred if you or your workers injure someone else physically or cause property damage as a result of the course of business. In this case, investigations, settlements, legal fees, and other litigation-related expenses are all covered by these insurance policies.

General Liability Insurance Cost:

The average cost of general liability insurance is $46 per month. However, this can vary from $21 to $166. Its annually average cost is between $250 to $2,000. The cost may differ depending on your business, years of operation, the number of clients, revenue, and claims history.

2. Commercial Property Insurance:

Commercial property insurance help to protect your owned or rented building, equipment, and property from breakdown, theft, and damage and will also recover lost income. However, this insurance does not cover the loss in case of mass destruction such as earthquakes and floods.

Commercial Property Insurance Cost:

The average cost of commercial property insurance is $85 per month. However, it can vary from $42 to $417. the annual average cost of commercial property insurance is $500 to $5,000. Your location and assets affect the cost.

3. Product Liability Insurance:

Product liability insurance is crucial if your company produces goods for sale. It protects your business from legal action related to a product produced and sold by the business.

Product Liability Insurance Cost:

Product Liability Insurance policies cost $180 per month. The annual cost varies from $800 to $2,000. Product Liability Insurance cost depends on factors such as how many are sold in a year, where your products are sold, and what the product is used for.

4. Business Owner Policy:

A Business Owner Policy (BOP) is a policy package that incorporates the essential insurance protections that are required by the majority of businesses. The business owner policies include general liability and commercial property insurance.

Business Owner Policy Cost:

The monthly cost of a business owner policy (BOP) is $100. It can range from $42 to $292 per month and $500 to $3,500 per year depending on your assets, location, and risks.

5. Professional Liability Insurance:

professional liability insurance will defend your business If a client or customer makes a claim against you for potential losses brought on by your service.

Professional Liability Insurance Cost:

The average monthly premium for professional liability insurance is $60. However, it can vary from $40 to $84 per month and $500 to $1,000 per year depending on your business, location, the number of employees, coverage, and restrictions.

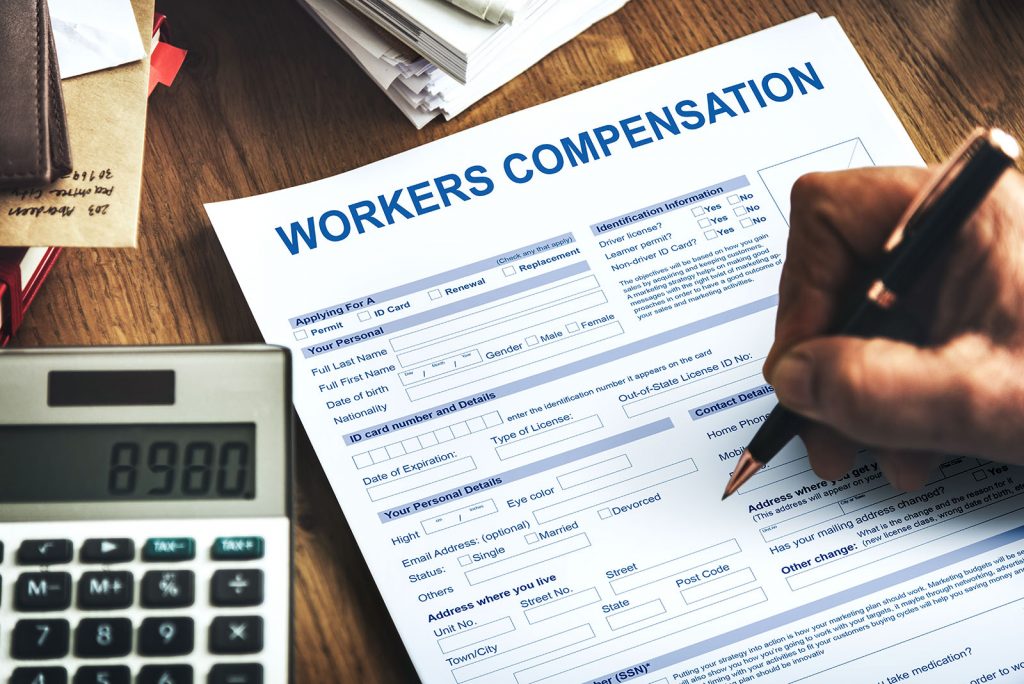

6. Workers Compensation Insurance:

Workers’ Compensation Insurance protects your employees’ medical expenses and wages lost as a result of an injury or illness on the job. The employees are not responsible for their own medical expenses.

Workers Compensation Insurance Cost:

Most workers’ compensation insurance policies cost $145 per month. The cost can vary from $5 to $84 as low and $240 as high and the annual cost varies from $500 to $1,000. Workers’ compensation Insurance cost depends on your industry, location, employees, coverage, and limits.

7. Commercial Auto Insurance:

commercial auto insurance protects you and your staff on the road if you use company-owned vehicles for work purposes. When your firm is at fault for an accident, it helps pay for property damage and physical injury claims.

Commercial Auto Insurance Cost:

The average cost of Commercial Auto Insurance is $150 per month. However, this can by location. Its annually average cost is $500. The cost may differ depending on the company’s revenue, number of employees, number of client records, and cyber security level to prevent hacks, data breaches, etc.

8. Cyber Liability Insurance:

cyber liability insurance policies defend your business from liabilities, losses, and damages as a result of data breaches and other cyber-attacks.

Cyber Liability Insurance Cost:

The average monthly premium for cyber liability insurance is $92. Depending on many elements like risks, industry, revenue, and location, the premiums might range from $63 to $667 per month and $750 to $8,000 per year.

9. Errors and omissions insurance:

Errors and omissions insurance (E&O) protects your business against allegations of carelessness, mistakes, and omissions that you made in the services you provided during the course work.

Errors and omissions insurance Cost:

The monthly cost for common errors and omissions policies is $145. The rates can vary from $75 to $167 per month and $900 to $2,000 per year depending on your profession, location, customers, and the number of staff.

How to keep your Business Insurance Cost Lower?

To minimize your small business insurance expenses, you should follow these steps.

- One of the best ways to keep your Business Insurance Cost Lower is to reduce the risks. Choose the insurance policies after carefully analyzing your company to discover any potential dangers.

- The best way to lower your business insurance cost is to pay the entire cost. You can pay your cost monthly, but paying the entire at once can give you a discount on your business insurance coverage.

- Bundling your policies is another way to keep your business insurance costs lower. Most insurance companies give you discounts if you combine multiple types of business insurance into one policy.

- You should invest in security measures to keep your business insurance costs lower. when you have specific security measures most insurance companies frequently offer discounts on certain liability coverage.

- You should compare insurance policy prices to lower your business insurance cost. The Prices for the same policy can vary greatly at different insurance companies. Before making a choice, make sure to obtain quotations from different insurance companies.

Protect Your Business with Business Insurance:

As a business owner, you need to understand all aspects of your business. You should understand what you need to insure and what kind of policies are ideal for your business. You should choose business insurance options and policies according to your business requirement to protect you from any kind of personal loss.